Ship from China to Mexico 2025: Complete Guide to Costs, Transit Times, Customs & IMMEX

Noel Murphy

Logistics Expert & Ecommerce Consultant

2025-11-20

Master shipping from China to Mexico with our 2025 guide. Learn about nearshoring trends, customs clearance (Pedimento), IMMEX benefits, transit times, real costs, and how to avoid detention at Mexican ports.

Here's what most ecommerce sellers and manufacturers miss about shipping to Mexico in 2025: Mexico isn't just another Latin American market—it's becoming the nearshoring hub of North America, and that changes everything about how you should approach China-Mexico logistics. The USMCA trade agreement, IMMEX manufacturing programmes, and booming cross-border e-commerce mean shipping strategies that worked in 2020 are completely obsolete today.

After managing thousands of China-Mexico shipments through our Shenzhen facility, I can tell you this: the sellers who succeed in Mexico understand the dual nature of this market—it's both a final destination for consumer goods AND a manufacturing gateway to the US. Mexican customs is strict (incomplete documentation = weeks of detention), but the rewards are massive: 130 million consumers, growing middle class, and duty-free access to US/Canada markets via IMMEX. Let me show you exactly how to navigate this opportunity in 2025.

🇲🇽 Mexico Shipping Quick Facts 2025

📊 Market Overview

- • Population: 130 million (11th largest globally)

- • E-commerce: $28B market, growing 25% YoY

- • Nearshoring boom: $40B manufacturing shift from China

- • USMCA benefits: Duty-free trade with US/Canada

- • Top ports: Manzanillo (50%), Lázaro Cárdenas, Veracruz

⚠️ Key Challenges

- • Complex customs: Pedimento + licensed broker required

- • High duties: 10-35% + 16% VAT + 8% DTA fee

- • Documentation strict: Missing docs = detention

- • Spanish language: Invoices/labels preferred in Spanish

- • Port congestion: Manzanillo delays during peak season

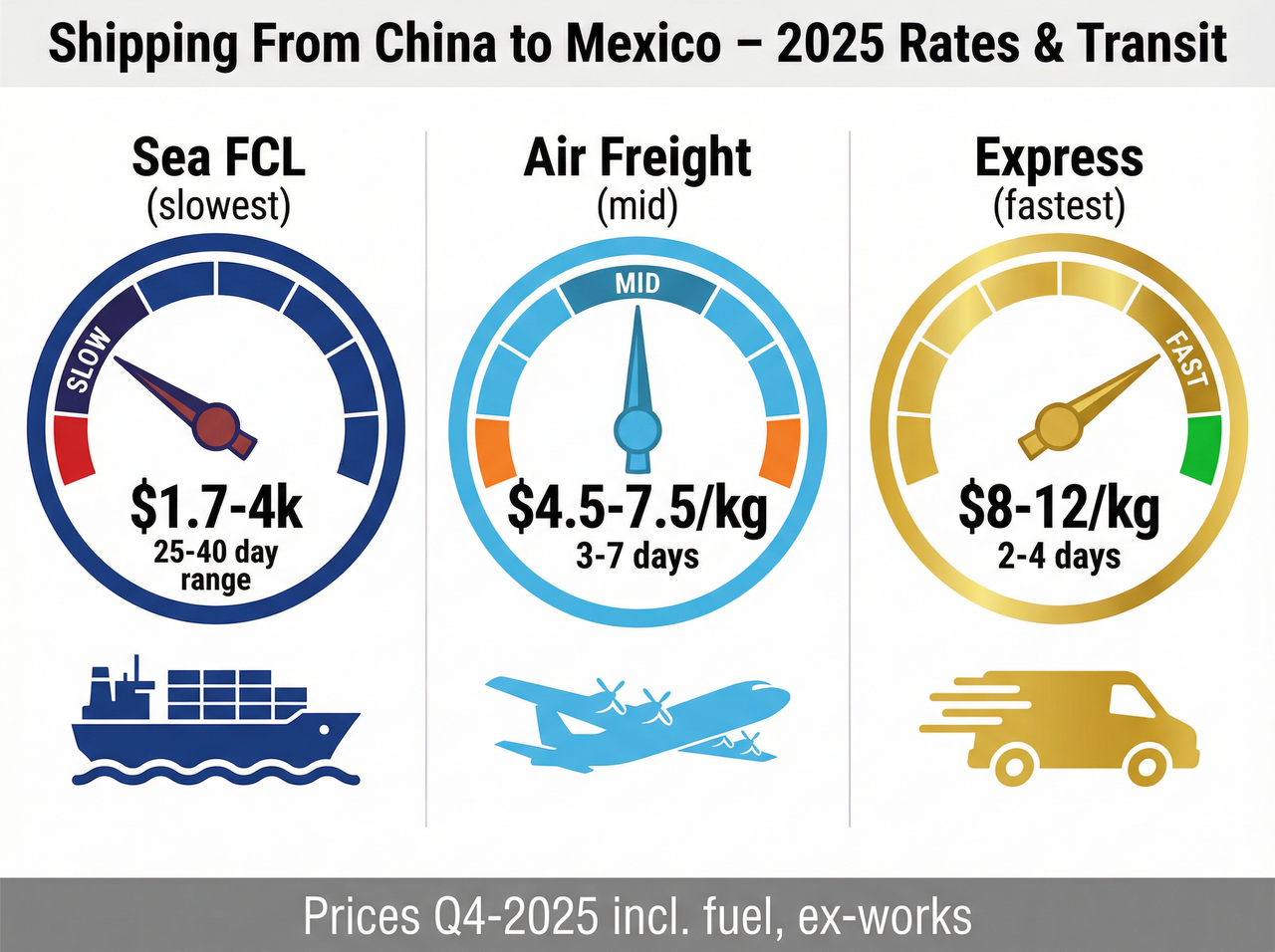

Section 1: Shipping Methods & Transit Times

Choosing the right shipping method to Mexico depends on your product type, urgency, and budget. Here's the complete breakdown:

Express Air Freight: 2-5 Days (Premium Speed)

✈️ Express Carriers (DHL, FedEx, UPS)

Speed & Reliability:

- • Transit time: 2-5 business days door-to-door

- • Route: Shenzhen/Shanghai → Hong Kong hub → Mexico City/Monterrey

- • Customs: Express clearance via carrier's customs broker

- • Tracking: Real-time updates, 99% on-time delivery

- • Best for: Samples, urgent orders, high-value electronics

Costs & Considerations:

- • Price range: $9-15/kg (actual weight or volumetric)

- • Minimum charge: $50-80 per shipment

- • Fuel surcharge: 15-25% additional

- • Duties/taxes: Collected at delivery (DDU) or pre-paid (DDP)

- • Volume discounts: 30-40% off with monthly 500kg+

Express air freight and standard air cargo transit times comparison for major China-Mexico routes

Standard Air Freight: 7-12 Days (Balanced Option)

🛫 Commercial Air Cargo

For shipments 100kg-500kg, commercial air freight offers the sweet spot between speed and cost:

Transit Time

7-12 days

- • Flight: 2-3 days

- • Customs: 3-5 days

- • Delivery: 2-4 days

Cost Range

$5-8/kg

- • 40-50% cheaper than express

- • Minimum: 100kg typically

- • Volume pricing available

Best For

- • Fashion/apparel shipments

- • Ecommerce inventory restocks

- • Medium-urgency orders

- • 100-500kg shipments

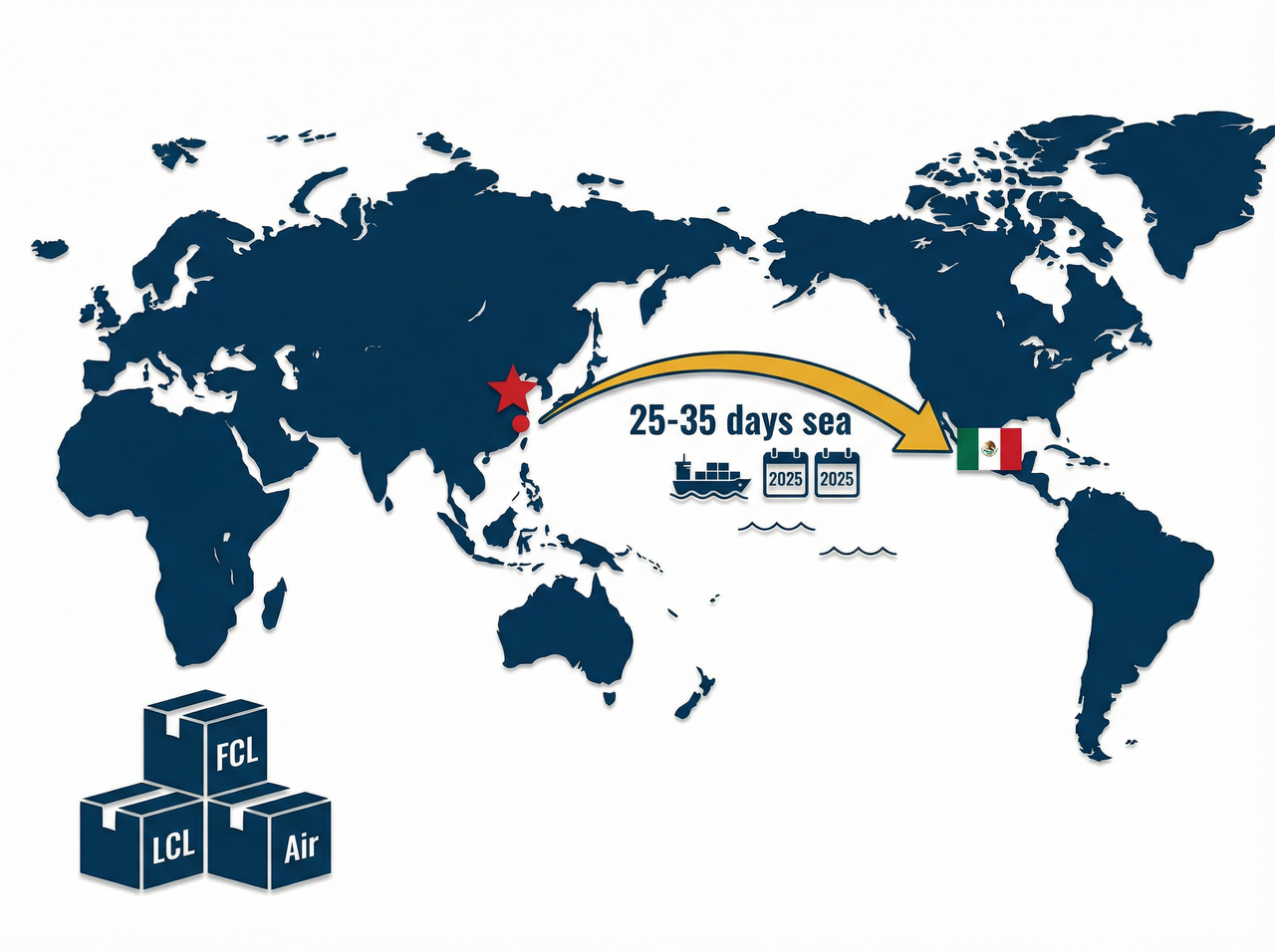

Sea Freight: 18-35 Days (Most Economical)

For large shipments (1+ CBM or full containers), sea freight is the most cost-effective option. Route selection dramatically impacts transit time:

| Route | Origin Ports | Destination | Transit Time | Best For |

|---|---|---|---|---|

| Pacific Direct | Shanghai, Ningbo, Shenzhen | Manzanillo | 18-22 days | West/Central Mexico, fastest route |

| Pacific to Lázaro Cárdenas | Shanghai, Ningbo | Lázaro Cárdenas | 20-25 days | Central Mexico, rail to US border |

| Gulf via Panama Canal | Shenzhen, Yantian, Hong Kong | Veracruz | 28-35 days | Eastern Mexico, closer to Texas |

| Gulf to Altamira | Yantian, Hong Kong | Altamira | 30-35 days | Northeast Mexico, limited capacity |

Major sea freight routes showing Pacific direct and Panama Canal routes with transit times

📦 FCL (Full Container Load)

- • 20ft container: $1,800-2,500 (Manzanillo), $2,200-2,800 (Veracruz)

- • 40ft container: $2,400-3,200 (Manzanillo), $2,800-3,500 (Veracruz)

- • 40ft HC (High Cube): Add $200-300

- • Best for: 10+ CBM, full pallets, heavy goods

- • Advantages: Lower per-unit cost, direct port-to-door, less handling

📦 LCL (Less than Container Load)

- • Price: $120-180/CBM (cubic metre)

- • Minimum: 1 CBM (some forwarders 0.5 CBM)

- • Transit: 25-35 days (consolidation + deconsolidation)

- • Best for: 1-10 CBM, mixed products, small businesses

- • Drawbacks: Longer transit, more handling, higher per-CBM cost

💡 Pro Tip: Peak Season Planning

Mexican import volumes surge September-November (holiday preparation) and February-March (Chinese New Year backlog). During peak season:

- • Ocean freight rates increase 20-30%

- • Port congestion adds 3-7 days to transit

- • Air freight space becomes scarce (book 2+ weeks ahead)

- • Customs clearance slows (paperwork backlogs)

Solution: Ship in August for September sales, or use bonded warehouse storage to pre-position inventory.

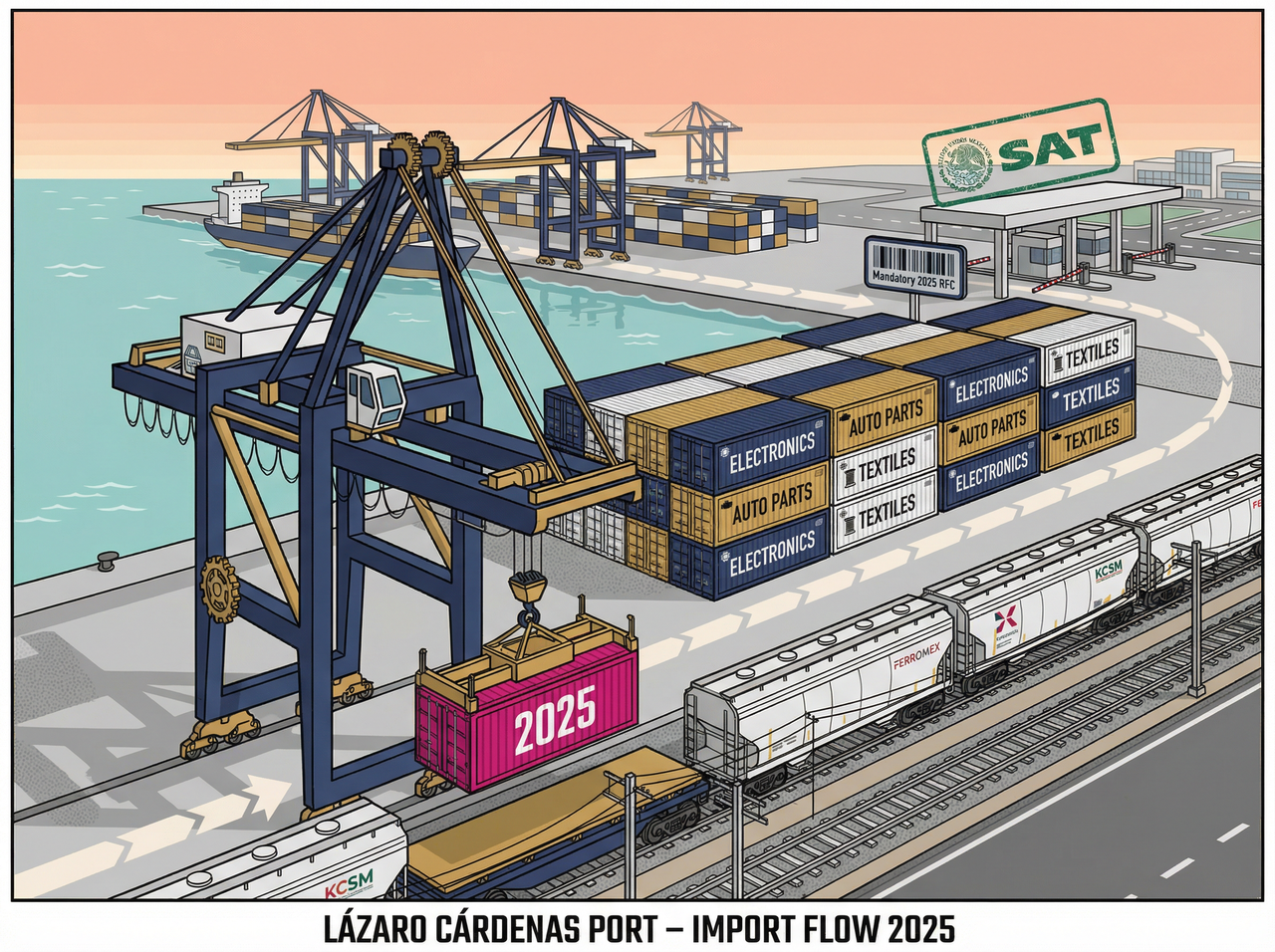

Section 2: Mexican Customs Clearance (Pedimento System)

Mexican customs is known for being strict, bureaucratic, and unforgiving of documentation errors. Unlike the US or EU where small mistakes might cause delays, in Mexico they cause detention, storage fees, and even cargo abandonment. Here's what you need to know:

The Pedimento: Mexico's Customs Declaration

The Pedimento is Mexico's official customs declaration document, and it must be filed by a licensed Mexican customs broker (Agente Aduanal). You cannot file it yourself, even if you're importing regularly.

📋 Required Information for Pedimento:

- • Importer's RFC: Mexican tax ID (12-13 characters, format: ABC123456XYZ)

- • HS codes: 8-digit Mexican tariff classification (more detailed than 6-digit international)

- • Commercial invoice: Detailed breakdown of goods, values, quantities

- • Packing list: Weights, dimensions, marks/numbers on packages

- • Bill of Lading: Original or telex release (sea) or Air Waybill (air)

- • Certificate of Origin: If claiming duty reduction under USMCA or other trade agreements

- • Product certifications: NOM compliance (electronics), health permits (food/cosmetics)

Customs Broker Fees & Process

Customs brokers in Mexico are mandatory and expensive:

- • Broker fee: $150-400 per shipment (depends on complexity and value)

- • Processing time: 2-5 business days if docs are complete

- • Incomplete docs penalty: 5-15 additional days + storage fees

- • Storage fees at port: $50-150/day for containers, $10-30/day for small shipments

How to find a broker:

- • Your freight forwarder can recommend partners

- • Verify they're licensed: Check SAT (Mexican tax authority) registry

- • Manzanillo/Veracruz have hundreds of brokers; choose ones with English support

- • PFC Express partners with licensed brokers in all major Mexican ports

Major Mexican ports handling China imports with modern container handling infrastructure

Common Customs Clearance Mistakes (And How to Avoid Them)

🚨 Top 5 Mistakes That Cause Detention

- 1. Incorrect or missing HS codes

- ❌ Using 6-digit international codes instead of 8-digit Mexican codes

- ✅ Verify codes at Ventanilla Única

- 2. Invoice discrepancies

- ❌ Value on invoice doesn't match B/L or packing list

- ✅ Ensure commercial invoice, packing list, and B/L all match exactly

- 3. Missing RFC (tax ID)

- ❌ Trying to import without Mexican RFC registration

- ✅ Register for RFC at SAT website before first shipment (free, takes 3-5 days)

- 4. Spanish language issues

- ❌ All documents in English only

- ✅ Provide Spanish translations or bilingual invoices (customs prefers Spanish)

- 5. NOM certification missing

- ❌ Importing electronics/appliances without NOM compliance certificate

- ✅ Obtain NOM certification before shipping (electronics, toys, textiles require it)

Section 3: Import Duties, Taxes & Fees

Understanding the total landed cost is critical for pricing your products correctly. Mexico's import tax structure has three main components:

The Three-Layer Tax System

💰 Complete Tax Calculation Example

Example: $10,000 Electronics Shipment (Laptops)

Step 1: Calculate CIF Value

- FOB China: $10,000

- Ocean freight: $400

- Insurance (1%): $100

- CIF Value: $10,500

Step 2: Import Duty (15% for laptops)

- $10,500 × 15% = $1,575

Step 3: VAT/IVA (16% on CIF + Duty)

- ($10,500 + $1,575) × 16% = $1,932

Step 4: DTA Fee (8% of duty, max varies)

- $1,575 × 8% = $126

Total Taxes: $3,633

Total Landed Cost: $10,000 + $400 + $100 + $3,633 = $14,133

Markup from FOB: 41.3%

Duty Rates by Product Category

| Product Category | Typical Duty Rate | Total Tax Impact | Notes |

|---|---|---|---|

| Electronics (computers, phones) | 0-15% | ~30-40% | Lower rates under USMCA if components qualify |

| Textiles & Apparel | 15-25% | ~40-50% | Higher for finished garments vs raw fabric |

| Toys & Games | 10-20% | ~35-45% | NOM certification required for safety |

| Home & Kitchen Goods | 10-18% | ~35-42% | Varies by material (plastic, metal, ceramic) |

| Cosmetics & Personal Care | 15-20% | ~40-45% | Health permit from COFEPRIS required |

| Automotive Parts | 15-35% | ~40-60% | Highest rates, complex classification |

Need Help with Mexican Customs?

PFC Express manages Pedimento filing, customs broker coordination, and duty optimization for 1,000+ Mexico shipments monthly.

Get Mexico Shipping QuoteSection 4: IMMEX Programme (Duty-Free Manufacturing)

If you're manufacturing in Mexico or importing components for assembly/re-export, the IMMEX programme can save you 15-35% in import duties. This is why nearshoring to Mexico is so attractive for US/Canada-bound products.

What is IMMEX?

IMMEX (Industria Manufacturera, Maquiladora y de Servicios de Exportación) is a Mexican customs programme that allows temporary import of raw materials, components, and machinery duty-free as long as they're used for manufacturing or re-export.

🎯 Key Benefits:

- • 0% import duties on raw materials, components, machinery

- • 18-month temporary import period (renewable indefinitely)

- • VAT deferral: Pay VAT only when selling in Mexico (not on imports for export)

- • USMCA qualification: Products manufactured under IMMEX can qualify for duty-free US/Canada entry

- • Submanufacturing allowed: You can outsource to Mexican maquiladoras

Who Should Use IMMEX?

✅ Ideal For:

- • US/Canada sellers: Importing components from China, assembling in Mexico, exporting to US/Canada duty-free

- • Electronics manufacturing: PCB assembly, product testing, packaging

- • Automotive suppliers: Parts manufacturing for US/Mexico auto plants

- • Textile/apparel: Cut-and-sew operations, garment assembly

- • Medical devices: Assembly, sterilization, QC for US market

❌ Not Suitable For:

- • Direct-to-consumer in Mexico: IMMEX is for export/manufacturing, not final sale in Mexico

- • Small order volumes: Setup costs ($5,000-10,000) make it viable only for $100k+ annual imports

- • No manufacturing: If you're just importing finished goods for Mexican retail, standard customs applies

- • Complex compliance: Requires detailed tracking, annual audits, inventory reconciliation

How to Apply for IMMEX Certification

Step-by-Step IMMEX Application Process:

- 1. Establish Mexican legal entity: Register a company in Mexico (SA de CV or similar), obtain RFC tax ID

- 2. Prepare documentation:

- • Business plan showing manufacturing/export activities

- • Proof of manufacturing capability (lease agreement, equipment list)

- • Financial statements

- • Technical description of manufacturing process

- 3. Submit application to Mexican Economy Ministry (SE): Online via SE portal

- 4. Processing time: 30-60 days (if docs complete)

- 5. Annual renewal: Submit annual report showing imports/exports reconciliation

💡 Pro Tip: Many companies use IMMEX shelter services—Mexican companies that hold the IMMEX licence and allow you to operate under their umbrella for 5-10% of import value. This avoids the complexity of direct registration.

Section 5: Nearshoring Trends & Mexico's Role in Supply Chain Diversification

In 2025, nearshoring to Mexico is the biggest supply chain trend for US companies. After COVID-19 exposed China-dependency risks, and with USMCA trade benefits, Mexico has become the #1 US import partner (overtaking China in 2023). Here's what this means for logistics:

📊 Nearshoring By The Numbers

- • $40 billion in manufacturing investment announced for Mexico (2022-2025)

- • Tesla, BMW, Samsung, LG building new factories in Monterrey, Nuevo León

- • 340,000+ manufacturing jobs added in Mexico (2023-2024)

- • Monterrey industrial real estate prices up 45% since 2022

- • Manzanillo port expansion: $600M investment to handle 40% more containers by 2026

The China + Mexico Strategy

Smart companies aren't abandoning China—they're using China for sourcing + Mexico for final assembly:

🌏 Hybrid Supply Chain Model

Step 1: Source Components from China

- • Ship PCBs, motors, plastics, fabrics from Shenzhen/Shanghai

- • Use sea freight (18-22 days, $2,000-2,500 per 40ft container)

- • Import under IMMEX programme (0% duties)

Step 2: Assemble/Package in Mexico

- • Final assembly, testing, packaging in Monterrey or Guadalajara

- • Add "Made in Mexico" labels

- • Qualify for USMCA rules of origin (often requires 30-75% North American content)

Step 3: Export to US/Canada Duty-Free

- • Truck to US border (Laredo, TX or San Diego, CA)

- • Clear US customs with USMCA certificate (0% duty)

- • 1-3 day delivery to US warehouses or customers

💡 Result: China manufacturing costs + US duty-free access + 2-day delivery

Section 6: Real-World Cost Comparison

Let's compare actual costs for shipping 1,000 units of a product (10kg total, 2 CBM) from China to Mexico via different methods:

| Method | Transit Time | Freight Cost | Additional Fees | Total Cost | Cost per Unit |

|---|---|---|---|---|---|

| Express Air (DHL) | 2-5 days | $1,200 (10kg × $12/kg) | $80 fuel, $200 customs | $1,480 | $1.48/unit |

| Standard Air | 7-12 days | $700 (10kg × $7/kg) | $50 handling, $200 customs | $950 | $0.95/unit |

| Sea LCL | 25-35 days | $300 (2 CBM × $150) | $150 port fees, $250 customs | $700 | $0.70/unit |

| Sea FCL (20ft) | 18-28 days | $2,000 (full container) | $200 port, $300 customs | $2,500 | $0.25/unit (10k units) |

💡 Cost Optimization Tips

- 1. Consolidate shipments: Shipping 10 CBM via LCL costs $150/CBM; shipping 20ft FCL (30 CBM) costs $67/CBM

- 2. Use IMMEX for repeat imports: Save 15-35% on duties if manufacturing/exporting

- 3. Negotiate carrier contracts: Monthly 500kg+ air volume = 30-40% discount

- 4. Time shipments off-peak: December-February sea freight is 20% cheaper than October-November

Section 7: Mexico Shipping Checklist

✅ Pre-Shipment Checklist

Ready to Ship to Mexico?

PFC Express handles China-Mexico shipping end-to-end: freight booking, customs documentation, broker coordination, and IMMEX support.

Get Mexico Shipping QuoteFinal Thoughts: Mexico as Your Strategic Supply Chain Partner

Most sellers think of Mexico as "just another export market," but that's missing the bigger picture. Mexico is the bridge between China's manufacturing prowess and North America's consumer demand. Whether you're dropshipping finished goods to Mexican consumers or using IMMEX to assemble components for the US market, understanding the logistics is your competitive advantage.

The winners in 2025 are the companies who master the China → Mexico → US supply chain: sourcing components from Shenzhen, assembling in Monterrey, and delivering to Texas in 48 hours. The losers are still trying to ship direct from China to US customers with 15-30 day transit times and unpredictable customs delays.

Mexican customs is strict, duties are high, and documentation errors are costly. But with proper planning—accurate HS codes, licensed customs brokers, IMMEX certification for manufacturers—you can turn Mexico into your nearshoring competitive moat. Work with logistics partners who handle Mexico daily, and let compliance become your advantage instead of your headache.

📞 Ready to Master Mexico Shipping?

Our Shenzhen team has managed 15,000+ Mexico shipments, partnered with licensed customs brokers in Manzanillo/Veracruz, and helped 200+ companies set up IMMEX programmes. We offer:

- • Sea freight booking (FCL/LCL) to all Mexican ports

- • Express/standard air freight with customs pre-clearance

- • Customs broker coordination and Pedimento filing

- • IMMEX consultation and duty optimization

Contact PFC Express:

- • Email: sales@parcelfromchina.com

- • Phone: +86 15338777612

- • LinkedIn: Connect with Noel Murphy

TAGS:

About Noel Murphy

Logistics Expert & Ecommerce Consultant